Reliance Client Merchandise Ltd (RPCL), the fast-moving client items arm of Reliance Industries Ltd, will purchase a controlling stake in Lotus Chocolate.

RCPL has entered into an settlement with the promoters of Lotus Chocolate, which manufactures candies, cocoa merchandise, and cocoa derivatives.

As a part of the share buy settlement, RCPL proposes to accumulate 77% of the paid-up share capital of Lotus Chocolate by a “secondary buy” from promoters Prakash Peraje Pai and Ananth Peraje Pai, adopted by an open supply.

“RCPL will purchase 65.48 lakh fairness shares of LOTUS representing 51% of the paid-up fairness share capital of LOTUS from the present promoter and promoter group… at a worth per share of Rs 113.00 aggregating to Rs 74 crore,” mentioned a joint assertion.

“RCPL and sure promoter group entities of LOTUS to subscribe to five.07 crore non-cumulative redeemable choice shares of face worth of Rs 10 every,” the assertion added.

RCPL would make an open supply for a further 26% stake, it additional mentioned.

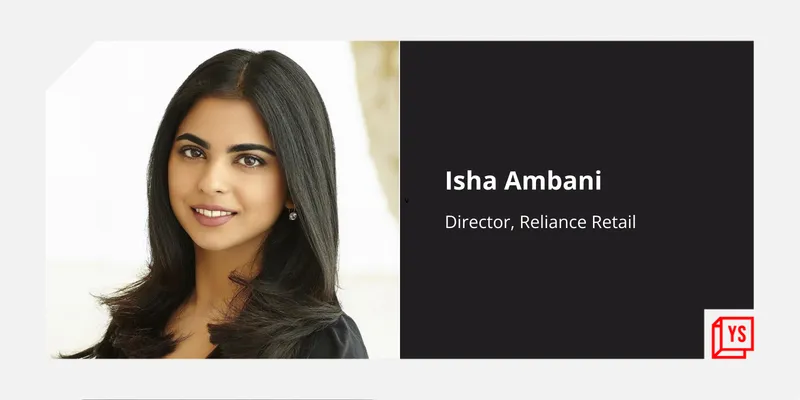

RRVL Government Director Isha Ambani mentioned, “The funding in LOTUS underlines our dedication to additional enhance indigenously developed every day use prime quality merchandise to serve a broad buyer spectrum at reasonably priced costs. We sit up for working with the extremely skilled administration crew of LOTUS as we additional develop the enterprise and drive its subsequent development section.”

Founder-Promoter of Lotus Chocolate, Abhijit Pai mentioned, “Our strategic partnership with Reliance, by this funding, will additional allow this imaginative and prescient and speed up Lotus’ transformation.”

Earlier, in a regulatory submitting, Lotus Chocolate mentioned a shareholders settlement (SHA) has been executed between RCPL and members of the promoter and promoter group, particularly Prakash Peraje Pai, Ananth Peraje Pai, Poornima Pai, Nivedita Pai, Ashwini Pai, Abhijeet Pai, Aman Paiand and Aditya Pai.

Lotus Chocolate mentioned its board authorized the execution of SHA, which might come into impact from the time limit as talked about within the share buy settlement (SPA) entered between RCPL and the promoters, particularly Prakash Peraje Pai and Ananth Peraje Pai.

As per the SPA, Prakash Peraje Pai and Ananth Peraje Pai proposed to promote fairness shares of the corporate to RCPL.

Each collectively personal 57% stake in Lotus Chocolate, as of the quarter ended September 2022.

“The transaction contemplated underneath the SPA and SHA has additionally triggered an obligation on RCPL to make an open supply to the general public shareholders of the Firm…,” it mentioned.

RCPL has ambitions to be a related participant within the FMCG phase. It had earlier this month launched its client packaged items model ‘Independence’.

RRVL Director Isha Ambani had on August 29 introduced the launch of its FMCG items enterprise in the course of the AGM of Reliance Industries.

Below the ‘Independence’ model, the corporate will supply a spread of merchandise in a number of classes, together with staples, processed meals, and different every day necessities. Earlier than this, Reliance had acquired the home-grown delicate drink model Campa.

In response to some reviews, it was additionally in talks to accumulate Backyard, Lahori Zeera, and Bindu Drinks, amongst others.

RRVL is the holding firm of all of the retail companies underneath billionaire Mukesh Ambani-led Reliance Industries. RRVL, by its subsidiaries and associates, operates over 16,500 shops and companions with over two million retailers.

It additionally operates a community of omnichannel companies by Jio Mart, Ajio, Netmeds, Zivame and different on-line channels.

In FY22, its consolidated turnover was Rs 1.99 lakh crore.